Image courtesy of Sammy Williams/Unsplash

Out with pollution perpetrators, in with deliberate diversity!

You would think that US investors are scrambling to reconfigure their investment portfolios, but you would be wrong. There is no rush to ESG investing in the US. Instead, it has been a slow process because in order to get there, we must change hearts, not only minds.

I have been pondering this since someone said ‘ESG investing will be successful when it is simply called investing’. So, yes, but there are intermediate steps, and the first is to agree the definition.

1. Clarify the ‘S’ and ‘G’

The definitions of E, S and G address many of the UN’s Sustainable Development Goals (“SDGs”). They provide a broad map to achieving a cleaner, better, healthier and more equal world for the Earth and all who (and that) live here. All worthy goals, but an awful lot to put under one umbrella.

Image courtesy of UN.org

- The “S” stands for social, but defining it is murkier…it can include diversity, data privacy, working conditions, child labor, health and safety, employee relations although it sometimes overlaps with G….

- And “G”, governance, which generally includes board structure, shareholders’ rights, bribery and corruption and product safety.

An authoritative non-commercial group should triage the ‘S’ and ‘G’ so everyone understands what they stand for.

How it could help: The United States is already grappling with two other complex issues: climate change and vaccine hesitancy. Another nebulous investment goal can tax the bandwidth of even the best and brightest investment minds.

2. Shine a light on poor practices

From the opposite perspective here is what E, S and G have in common: They have been all been underestimated, overlooked or ignored by investment managers — and by the public — for a long time.

For example: In the west, most would agree the use of child labor to manufacture things such as clothing or chocolate is terrible. It would not be ignored or overlooked, you say. But the facts say otherwise.

- According to this 2021 article in The Guardian, lawsuits suggest that as recently as the 2010s US companies such as Mars and Hershey were using child labor in the manufacture of products.

- And this screenshot from the US Department of Labor’s 2020 report on Child Labor and Forced Labor shows that child labor is still a problem globally and across many industries.

Regardless of the reason, these companies can and do make it into ESG investment portfolios. True ESG investing means that will have to change.

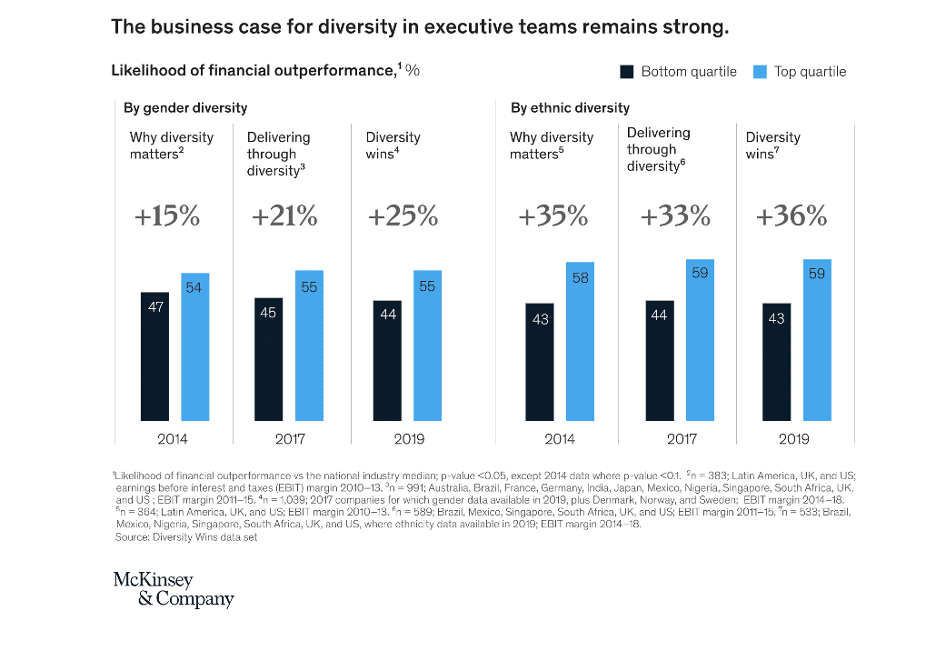

In the investment world, multiple studies show that increased diversity (which aligns with SDG 5-Gender Equality and SDG 10-Reduced Inequalities) leads to better corporate decision-making.

- For example, this McKinsey paper showed that diversity in Board composition and senior management ranks correlates with improved financial returns, and showed it over multiple time periods. The following graph from that report is compelling.

- Another study of the venture capital industry conducted by Paul Gompers at Harvard Business School summarized in this HBR article came to this conclusion:

Venture capital firms that increased their proportion of female partner hires by 10% saw, on average, a 1.5% spike in overall fund returns each year and had 9.7% more profitable exits (an impressive figure given that only 28.8% of all VC investments have a profitable exit).

Despite this evidence, there is far from clear agreement on whether ‘social’ issues are the responsibility of corporations. These types of decisions also require a confluence of motivation from heart and mind.

3. Decide between conflicting strategies

Image courtesy of geralt/Pixabay

Inclusion vs exclusion (or divestment); There is disagreement as to when and whether exclusion is the right strategy.

In addition, last year’s Department of Labor ruling that made it difficult for plans governed by ERISA to invest in strategies that used exclusion to implement ESG views will likely be replaced with the Biden Administration’s new “Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights”.

My personal view is that while exclusion or divestment may work when used against a smaller company, most of the worst offenders are so big that avoiding investment does not put much pressure on either the stock price or on management. That said, it should not be ruled out as a tactic.

4. Eliminate challenging tradeoffs

An overarching question: Assuming you believe exclusion is the way to express your beliefs, do you invest in ‘best in class’? Many index-like ESG funds include companies like Chevron Corp., which Sustainalytics rates as a “severe [ESG-related] financial risk”. Even though Arabesque says it contributes significantly to global warming, this report by MSCI says it is in the ‘top 10 common holdings’ list of ESG funds.

Tradeoffs can be granular, too. For example wind turbines are energy-intensive to build, produce large long-lived non-recyclable blades and can harm the habitat for wildlife, fish and plants. The spinning blades can pose a threat to birds and bats. So, do you vote for blades, or bats and birds?

5. Resolve the debate: ESG rating as a decision point or datapoint?

Image from lukasbieri/Pixabay

Decision point: Many US funds use a particular ESG score as a decision point to get into the portfolio. Nine of the 20 largest ESG-themed funds as of 2021 were designed to track an index but invest only in companies in the index that meet an ESG rating hurdle.

For example, the Goldman Sachs JUST US Large Cap Equity ETF (“JUST ETF”) tracks the JUST US Large Cap Diversified Index — which represents the companies that score best in the Russell 1000 Index when rated on ‘worker-related issues like pay, benefits and treatment’… the ‘S’ — social factor.

Datapoint: On the contrary, at Logan Capital we believe the best way to incorporate ESG into investment decision making is as a datapoint in our ESG-sensitive Growth strategy, GrowthPlus ESG.

In universe creation we use Wall Street analysts’ raw earnings growth revisions adjusted for various measures of risk that include the financial risks tied to E, S and G issues, provided by Sustainalytics. We believe this approach is more effective than trying to conduct detailed analysis of individual issues with what today are still limited tools.

What is changing: For firms that do not conduct internal ESG research, the vast majority of research is provided by a handful of firms that are dedicated to ESG research. However, an increasing number of traditional Wall Street firms now provide at least some ESG-themed research — either factored into traditional analysis or as a separate analysis. This points to a maturing of ESG research so that investment strategies could rely on ESG criteria as granular datapoints instead of one broad score. Meanwhile, there is room for both approaches.

So how close are we?

Pretty close — on the cosmic scale.

Image courtesy of NASA/JPL-Caltech/ESA/Harvard-Smithsonian CfA

Just kidding.

In investment management as in real life, when a topic is the subject of headlines, articles and conferences it sets off a necessary and valuable discussion and debate. In my opinion, this valuable discussion is overdue.

In perspective: One of the world’s largest pools of capital has the power to constructively allocate that capital in a way that respects the planet, provides increased opportunity to its human inhabitants and preserves habitats so that other species from mammals to invertebrates to single-celled organisms can continue to coexist with humans and thrive.

In Europe, already, this funneling of capital is taken seriously. There is no good reason not to. The US is later to the game however I believe it is an inexorable march.

These five things stand between inaction and successful integration. Resolution of these points will be a formidable step forward, so that one day, we will just call it “investing”.

Exchange Traded Funds (ETF’s) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Indices are unmanaged and investors cannot invest directly in an index.

The Russell 1000 is a market capitalization-weighted index of 1,000 of the largest companies in the U.S. equity markets, the Russell 1000 is a subset of the Russell 3000 Index. The Russell 1000 comprises over 90% of the total market capitalization of all listed U.S. stocks, and is considered a bellwether index for large cap investing.

Deborah G. George

Managing Director

Logan Capital Management